Performance

Prudent Management,

Competitive Yield*

* Past performance does not guarantee future results, which may vary.

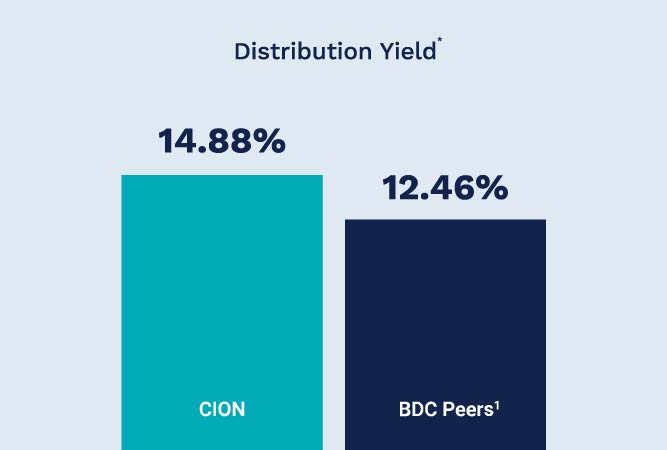

- Distribution yield is calculated as trailing twelve-month paid distributions using the Q2 2025 base distribution paid on June 16, 2025, divided by the closing market share price as of July 3, 2025. There is no guarantee distributions will continue at the current level, if at all.

- As of March 31, 2025. The loss rate is calculated by CION based on operations since December 2012 (inception) as the aggregate investment cost at write-off, less (i) any economic benefit realized during the loan (interest and fees) and (ii) any economic recovery, divided by the total invested capital. This rate is presented on an annualized basis and, with rounding, is approximately zero percent since CION’s inception. Also, this rate is presented to demonstrate CION’s investment portfolio characteristics and does not reflect the investment performance experienced by a CION investor.

CION’s Distributions Outperforms BDC Peers1

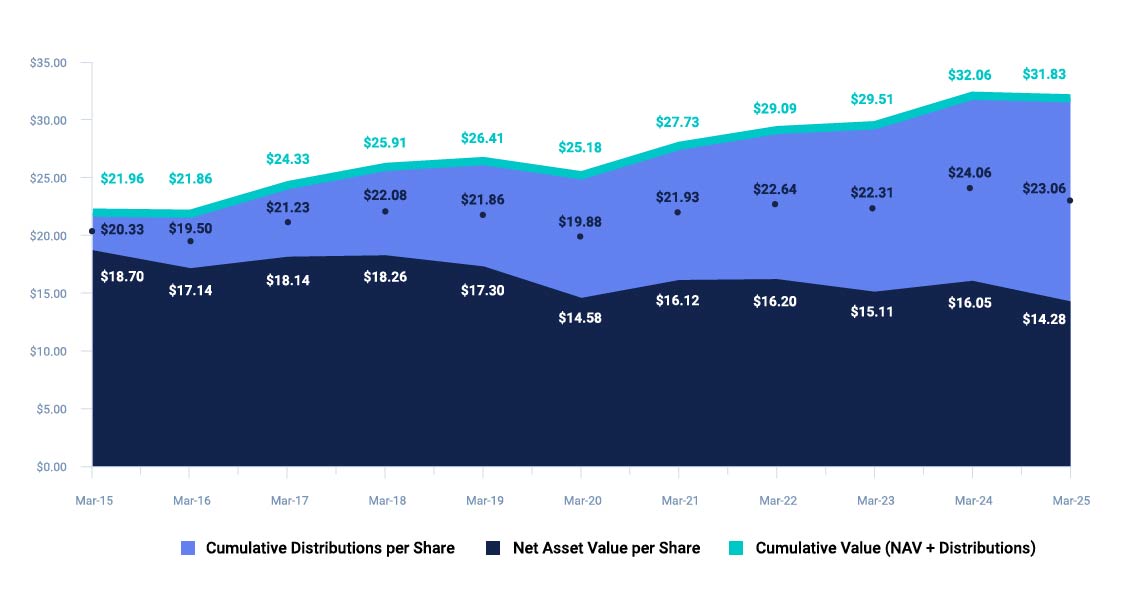

As of 3-31-2025

Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur. Distributions may not continue at the current level, if at all.

*Distribution Yield is calculated as trailing 12 month quarterly distributions declared as of March 31, 2025, divided by market share price as of March 31, 2025.

History of Value Creation

- CION’s BDC Peers consist of 14 externally managed, publicly-traded BDCs with a senior secured focus and a market capitalization between approximately $4.033bn and $545mm as of March 31, 2025.The peer group consists of: Bain Capital Specialty Finance Inc. (BCSF), Barings BDC Inc. (BBDC), BlackRock TCP Capital Corp. (TCPC), Carlyle Secured Lending, Inc. (CGBD), Crescent Capital BDC, Inc. (CCAP), Goldman Sachs BDC Inc. (GSBD), Golub Capital BDC Inc. (GBDC), New Mountain Finance Corporation (NMFC), MidCap Financial Investment Corp. (MFIC), Oaktree Specialty Lending Corp. (OCSL), PennantPark Floating Rate Capital Ltd. (PFLT), SLR Investment Corp. (SLRC), Sixth Street Specialty Lending Inc. (TSLX) and Prospect Capital Corporation (PSEC).