Why Invest in CION

*Distribution yield is calculated as trailing twelve-month paid distributions using the Q2 2025 base distribution paid on June 16, 2025, divided by the closing market share price as of July 11, 2025. There is no guarantee distributions will continue at the current level, if at all.

Why Invest in CION

(NYSE: CION)

We believe private credit has earned a place in investor portfolios as a core holding alongside traditional fixed income. We also believe that our long track record, strong performance and defensive positioning allows CION to help investors navigate increased volatility, and generate attractive income.

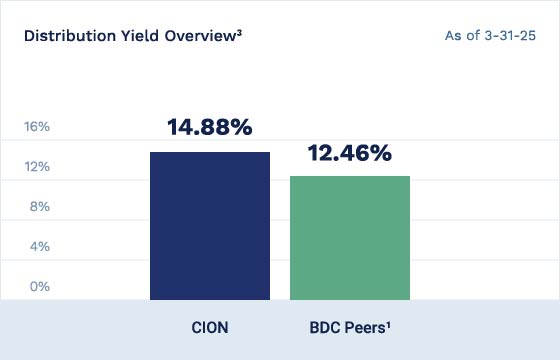

CION vs BDC Peers1

Distribution Yield

CION’s distribution yield at quarter-end is higher than many of its BDC Peers1 and, since its NYSE listing in October 2021, CION has fully covered its distributions from net investment income (NII).2

Trades at a Discount to NAV

On Market Price to NAV4, CION trades below many of its BDC Peers1 despite having what we believe is a strong senior secured portfolio.

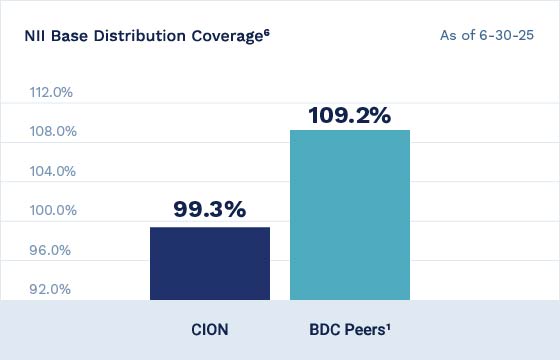

Base Distribution Coverage

CION’s NII has historically outearned its base distribution, including as of March 31, 2025.5

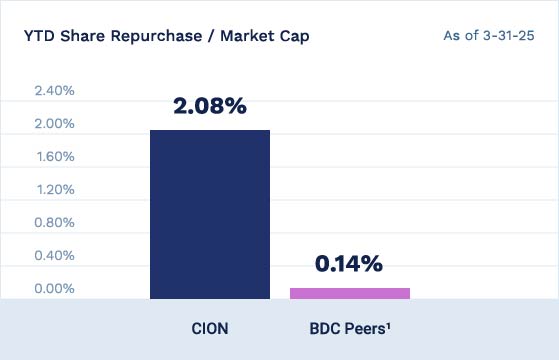

YTD Share Repurchase / Market Cap

CION has supported its stock through accretive share repurchases in the open market since the commencement of its share repurchase program in August 2022, including as of March 31, 2025.7

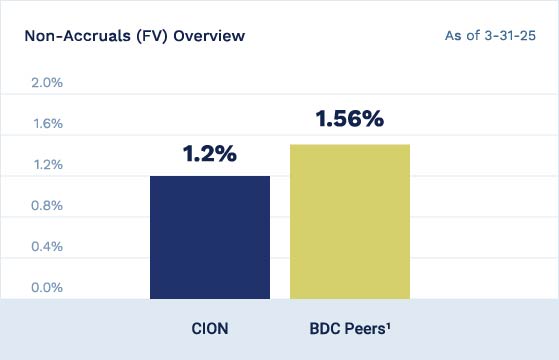

Non-Accruals (FV) Overview8

CION’s non-accrual rate as a percentage of fair value

compared to its BDC Peers1

All information is as of March 31, 2025, unless otherwise noted. Past performance does not guarantee future results, which may vary. Refer to Endnotes for additional important information.

Our Advantage:

Strong Sourcing + Selectivity

CIM sources direct first lien and club investments based on deep, long-standing relationships, including with other private and public lenders. CIM’s direct origination also provides a unique and proprietary flow of transactions.

CIM’s targeted EBITDA focus and deal size allows it to be highly selective in creating CION’s portfolio, which can provide income and downside protection.

Our Investment Criteria

US middle-market with annual EBITDA of $25-75 million

First lien, unitranche, second lien, and equity co-invest capabilities

3-8-year tenor

Flexible amortization

Maximum underwriting of $100 million (average targeted hold size of $30 million)

Typically requires covenant package

Management Team

Mark Gatto

Co-Founder, Co-CEO of CION

Investments/Investment

Committee Member

Michael A. Reisner

Co-Founder, Co-CEO of CION

Investments/Investment

Committee Member

Gregg Bresner

President & Chief

Investment Officer of CION

Investment Management

Keith Franz

Managing Director, Chief Financial Officer of CION Investment Management

Geoff Manna

Senior Managing Director

Aditi Budhia

Senior Vice President

Joe Elsabee

Managing Director

Eric Pinero

Chief Legal Officer

Stephen Roman

Chief Compliance Officer, Counsel

Nicholas Tzoumas

Director

Charlie Arestia

Managing Director and Head of Investor Relations

Board of Directors (Six of Eight Independent)

Mark Gatto

Co-Founder, Co-CEO of CION

Investments/Investment

Committee Member

Michael A. Reisner

Co-Founder, Co-CEO of CION

Investments/Investment

Committee Member

Robert A. Breakstone

President & CEO of Landmark International Group, Inc.

Peter I. Finlay

Founder & Managing Principal

of Ardentis LLC

Aron I. Schwartz

Managing Director of ACON

Investments

Earl V. Hedin

Co-Founder & Managing

Partner of Hudson Partners

Group LLC

Catherine K. Choi

President of BULBRITE

Industries

Edward J. Estrada

Principal of Estrada Legal

Consulting

Endnotes*

- CION’s BDC Peers consist of 14 externally managed, publicly-traded BDCs with a senior secured focus and a market capitalization between approximately $4.033bn and $545mm as of March 31, 2025. The peer group consists of: Bain Capital Specialty Finance Inc (BCSF), Barings BDC Inc (BBDC), BlackRock TCP Capital Corp. (TCPC), Carlyle Secured Lending, Inc. (CGBD), Crescent Capital BDC, Inc. (CCAP), Goldman Sachs BDC Inc (GSBD), Golub Capital BDC Inc (GBDC), New Mountain Finance Corporation (NMFC), MidCap Financial Investment Corp (MFIC), Oaktree Specialty Lending Corp (OCSL), PennantPark Floating Rate Capital Ltd. (PFLT), SLR Investment Corp (SLRC), Sixth Street Specialty Lending Inc (TSLX) and Prospect Capital Corporation (PSEC).

- NII distribution coverage from CION’s public listing on October 5, 2021 is based on GAAP Net Investment Income and applies for the full period noted, not for individual quarters. Distributions may not continue at the current level, if at all.

- Distribution yield is calculated as trailing 12 month quarterly distributions declared as of March 31, 2025, divided by market share price as of March 31, 2025. There is no guarantee distributions will continue at the current level, if at all.

- Net Asset Value, or NAV, is determined by dividing the total assets of CION (the value of CION’s portfolio investments and other assets, less any liabilities), by the total number of shares outstanding. Market price as of March 31, 2025.

- The period covered for NII distribution coverage is from CION’s public listing on October 5, 2021 to March 31, 2025, based on GAAP Net Investment Income, and applies over the full period noted, not for individual quarters. Distributions have been and may in the future be funded through sources other than cash flow from operations. Each year, information regarding the sources of CION’s distributions (i.e., whether paid from ordinary income, paid from net capital gains on the sale of securities, and/or a return of capital, the latter of which is a nontaxable distribution) will be disclosed to its shareholders on CION’s website at www.cionbdc.com. Distributions may not continue at the current level, if at all.

- Distribution coverage for the period of the latest quarter is calculated by taking the prior quarter’s net investment income divided by the prior quarter’s base distribution, which excludes supplemental and special distributions. Adjusted net investment income is used when available. Distributions may not continue at the current level, if at all.

- CION’s current repurchase trading plan expires on August 19, 2025, and is subject to price, market volume and timing restrictions. The repurchase trading plan may be suspended or discontinued at any time and does not obligate CION to acquire any specific number of shares of its common stock. There is no guarantee repurchases will continue at the current level, if at all.

- Non-accrual statistics are calculated as a percentage of total investments at fair value. If the non- accrual statistic was calculated as a percentage of total investments at cost, CION and its BDC Peers had investments on non-accrual status of 3.2% and 3.6%, respectively.